Our shopping centre research services uncover fresh insights that will act as a powerful tool enabling you to:

- Understand your competitive position

- Communicate more effectively with your current and potential customers

- Identify opportunities in the marketplace

- Minimise risks and make more robust business decisions

- Expand market share

- Develop the right products, services and experiences

- Uncover and identify potential drivers and barriers

- Create benchmarks and help track your progress

- Evaluate your success

- Gain a competitive advantage

In short, we empower you to unlock the potential of your business.

The Basic Requirements of Shopping Centre Research

Individual shopping centre consumer research is customised to a particular asset; typically there are two basic research requirements for any individual shopping centre:

- Customer Exit Survey (including trade area mapping)

- Centre and Market Assessment

Shopping Centre Management should have this essential information regarding the centre’s profile before any large scale development or re-development is undertaken.

At centre level, research is customised to a particular asset and typically takes the form of:

- Customer Exit and Intercept Surveys

- Telephone Surveys

- Focus Groups

- In-depth Interviews

- Data Analysis

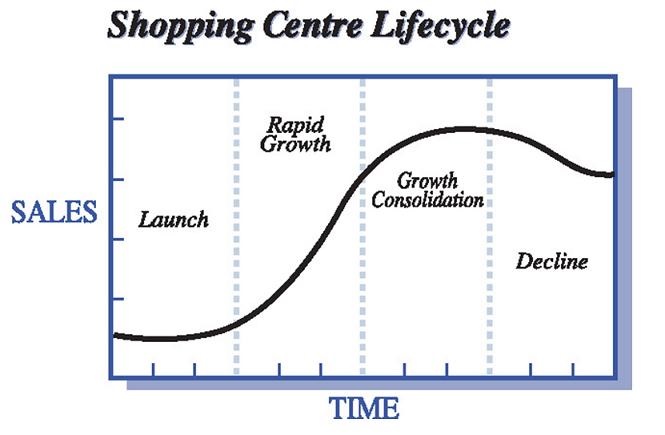

Lifecycle Analysis

Armed with the basics Directional Insights can assist you to determine which stage in the Shopping Centre Lifecycle your asset sits.

Depending on where your asset sits will determine the short and long term strategy required to maintain growth. It will also determine the type of research required to support the asset strategy at any given time.

Research Prior to Development/Re-development/Launch

Consumer Assessment comprising:

- Qualitative research usually via focus groups (to understand the customer and test proposed options)

- Quantitative research usually via telephone survey (to test proposed options and market conversion)

- Qualitative research (to test final option and detailed design and retail mix delivery)

Economic Assessment to:

- Determine market potential and characteristics

- Understand current and potential market demographics

- Assess competition and consumer spending leakage

- Analyse site potential for remix or development

Rapid Growth Phase

The first 6 to 12 months post launch are critical. During this time there are two types of research that are employed to ensure long term issue reduction in any Shopping Centre environment:

- Customer Exit Survey

- Market and Centre Composition Analysis

At this stage it may also be necessary to prepare a research contingency plan if the asset does not perform to expectations.

Growth Consolidation Phase

To ensure the continued growth of your asset, ongoing research in the form of Market and Centre Assessments and Customer Exit Surveys should be conducted every 2 to 3 years.

Lifecycle Renewal (Avoiding Decline) Phase

Understanding exactly where your asset is on the lifecycle curve and how long it takes to move through each phase is key to deploying Lifecycle Renewal through centre rejuvenation or development prior to decline setting in.

Additional Research Types

At a portfolio level, and even for major projects and developments at an individual centre level, it is common to obtain the views of retailers and to conduct comparisons with the industry at large.

Stakeholder View – Retailer

Assessing the needs and concerns of the retailer market, both existing and potential, helps to provide an understanding of their desires for the centre’s and overall industry’s development.

Shopping Centre Industry View

Industry Benchmarking is a valuable comparison and evaluation tool which allows you to measure the performance of your asset/centre against the performance of the industry.

By benchmarking this type of consumer behaviour the centre’s strengths and weaknesses, from a customer usage point of view, can more quickly be identified, and therefore, forward strategies can be put in place for centre improvement and/or redevelopment.

Directional Insights has undertaken extensive research in this area resulting in the development of Australia’s most comprehensive range of Consumer Shopping Behaviour Benchmarks.

The Series, which demonstrates how Australians use shopping centres and how we shop, includes over 1,000 vital performance measures which members of the Shopping Centre and Retail Industry can use to assist with the continuous improvement of their assets.

To request a more detailed explanation of the Shopping Centre Lifecycle and a Guide to Research Practices in the Shopping Centre Industry, please click here.