The Australian Consumer and Shopper Behaviour (ACSB) Report provides data on a broad range of consumer shopping behaviour and purchasing patterns. In this article we examine the homemaker sector by combining the data sets of consumers who have purchased homewares andmajor household items in the past 6 months. For the purposes of this article, we’ll describe these shoppers as purchasers in a ‘Home Improvements’ category.

Those who make purchases in this category can be segregated into two distinct shopper profiles: Engaged and Disengaged shoppers. The former regularly purchase items in the Home Improvement category (every two months or more often); the latter only purchase in the category once every six months or less.

Engaged and Disengaged shoppers differ not only in their shopping frequency, but in their approach to shopping.

Demographic Indicators

Income and age are two of the main drivers of Engagement for Home improvement shoppers: Engaged shoppers tend to be younger with higher average household incomes. This presents some unique challenges as younger shoppers tend to be less loyal and are more research driven in purchasing preparation.

Engaged Home Improvement shoppers are also more likely to be living in households with children (40%). It should be noted that shoppers living in this household structure are becoming increasingly engaged with online as a purchasing platform. Their influences are also more likely to be digital as they are utilising a myriad of sources such as search engines, facebook and retailer’s and manufacturer’s websites. Paradoxically, they are also increasingly attracted to shopping centres for the convenience and atmosphere.

Of those customers with children, Young Families are the powerhouse for the home improvement category and make up nearly a third of all Engaged customers. However this is a time poor category, with almost three quarters working full-time or part-time, so efficiency and convenience are very important to these shoppers.

Behavioural Patterns

The purchasing process that shoppers go through has forever changed, becoming increasingly complex and multifaceted. No longer do shoppers traverse a straight line to purchase; instead we see a highly dynamic journey, characterised by multiple considerations and influences resulting in a more informed and practical decision to buy.

Shoppers know they now have more power to choose where they shop, when they shop and how much they pay. This practical approach to shopping means they are less likely to impulse buy and more likely to be actively searching for the best value. This is particularly the case with Engaged shoppers who shop through a greater variety of retail channels.

Engaged shoppers are willing to look beyond the shopping centre when purchasing, suggesting dissatisfaction with the offer of mass merchants, and a desire for more individuality and eclectic ranges.

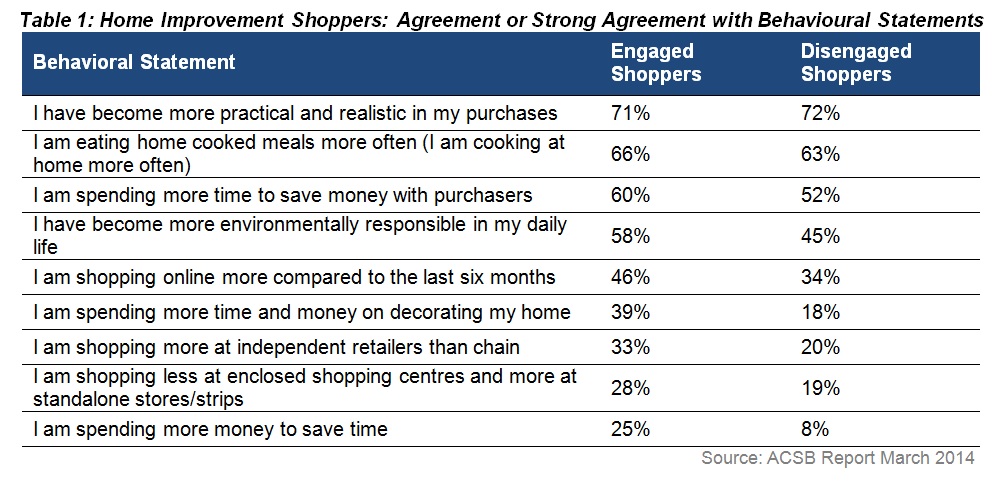

Table 1 demonstrates these trends, as well as a willingness by Engaged shoppers to invest both time and money in maximising purchasing value.

Marketing

Homemaker and Large Format Retail centres face a number of challenges in getting their message out to customers as they tend to have smaller marketing budgets and larger, more diverse trade areas than traditional shopping centres.

On top of these obstacles, the rise of digital media has brought fragmentation, increasing the channels through which customers want to hear about specials and events – be it by social media, SMS or through contextual marketing.

At homemaker centres approximately 50% of customers are aware of promotional activity conducted by the centre. This means that the other 50% of customers are not aware of any marketing.

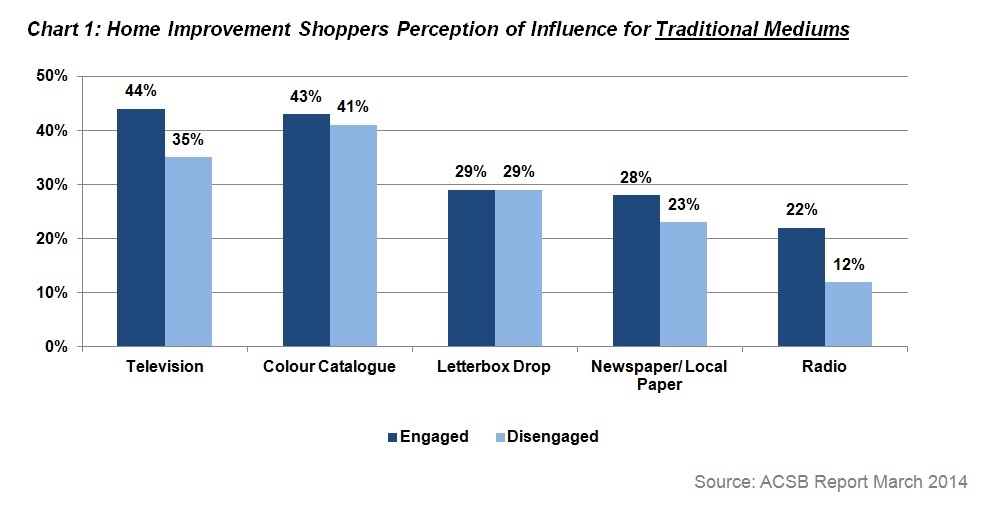

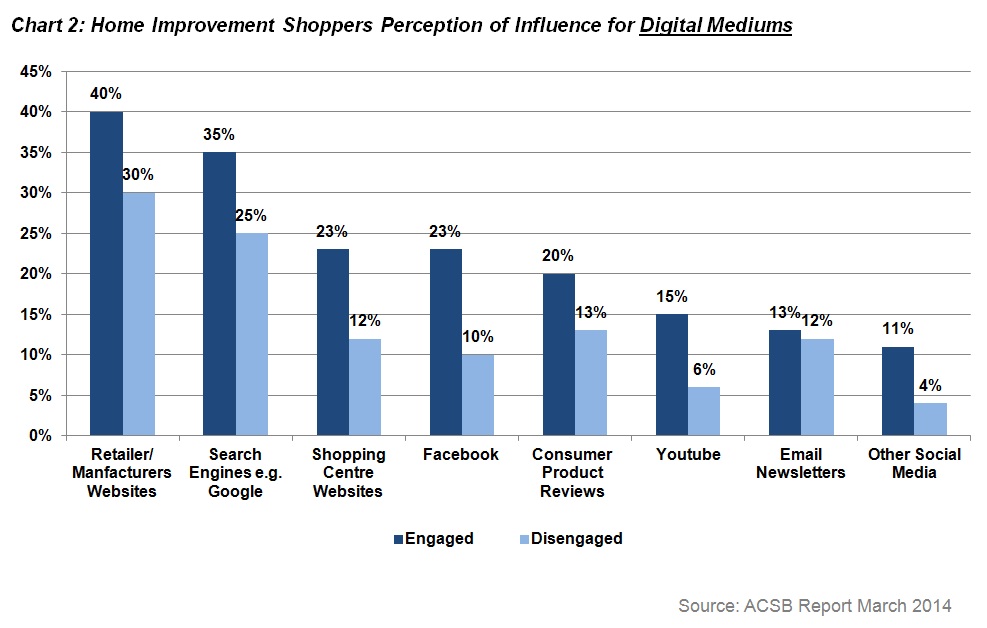

When looking at specific media influences for shoppers in the Home Improvement category, we see that again Engaged and Disengaged customers vary in their consumption patterns. Chart 1 demonstrates an ongoing strong appeal for traditional media across both shopper types. Chart 2 shows, however, that we find more diversity when looking at the consumption of digital media marketing.

This analysis shows that there are distinct ‘types’ of Home Improvement shoppers that evince different shopping, spending and marketing consumption patterns. Retailers and centres in this category should be aware of these differences, coaxing greater visitation from Disengaged shoppers, and ensuring satisfaction amongst regular visitors. It is worth noting the proclivity of Engaged shoppers to look elsewhere, including online. As big spenders and regular visitors these customers are important to retain. An awareness of product mix, variety, good service and online competition remain very important in doing so.