If you’ve been following e-directions for a while, you’ll be familiar with the rise of Mission shopping that followed the GFC corrective.

At the same time as consumers became more cautious (and conscious of their buying patterns!), online retailing activity grew, providing ever more information about products, pricing and competition.

The expansion of Mission shopping was not enormous – just a few percentage points – but it made a difference (especially when we consider categories beyond Food Retail).

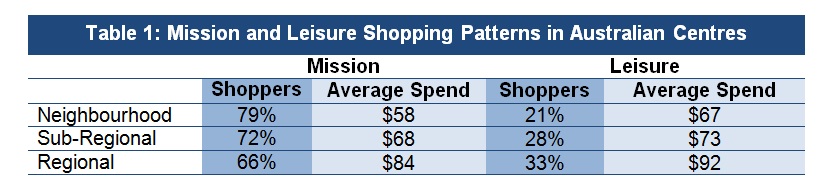

One of the objectives of the ‘experiential’ shopping movement over the last few years has been to shift shoppers, particularly in discretionary categories, back towards Leisure shopping patterns. Not least because in traditional shopping centres the average spend of Leisure shoppers is consistently higher than that of Mission shoppers.

Table 1 provides a brief summary of Mission/ Leisure shopping patterns from Directional Insights Consumer Shopping Benchmarks 2013. For a detailed analysis, with data, refer to our article in the Feb 2013 edition of e-directions.

Retail has always had to cater to both the Leisure and Mission shopper. One of the reasons that the Australian shopping centre industry has been so successful is because it has done this very well. There has been, for a long time, a good mix of Neighbourhood, Sub-Regional and Regional centres, which have grown and adapted over time, keeping pace with changes in shopping and leisure patterns.

In centres of all sizes, convenience has been effectively married with pleasant environments. We’ll look further at Leisure shoppers and experiential shopping in the next edition of e-directions, but here we’d like to give you some more information about Mission shoppers.

We all know that men and women shop differently. This is again true when we consider Mission and Leisure shopping patterns. For starters, men are more likely to Mission shop than women. Whilst some men do enjoy the shopping experience, and are willing to browse, many simply want to get what they came for and get out quickly. The average length of shopping trips is still a lot longer for female Mission shoppers than it is for male Mission shoppers (54 minutes compared with 40 minutes). Female Mission shoppers also spend more ($78 compared with $57), are more likely to make a purchase overall, and are more likely to purchase in all categories except Food Catering and Bulky Goods, where the chance of a sale is roughly equal.

Female Mission shoppers average spend in all categories is higher than their male counterparts. Last year we gave you some figures on Apparel shopping (here and here), noting that it was conducive to Leisure or experiential shopping. None-the-less, we all regularly Mission shop for clothes when we need something quickly, identify some must-have items, or simply have other things to get on with (I bought 4 shirts last night in half an hour at a regional centre). So in terms of provision, it’s important to combine pleasant Apparel shopping experiences with efficiency.

As women make up 85% of Apparel shoppers, let’s take a quick glance at their Mission shopping behaviour in this category. The first thing that jumps out from the data is that while women on a Mission shop for Apparel spend less than Apparel shoppers overall ($115 compared with $122), their spend is still strong. Like Leisurely Apparel shoppers, they also have a broad spread of expenditure, grabbing some clothes items in conjunction with other activities, particularly purchasing Food Retail.

Centres performing well on cross-spend here are gaining customer traction through good tenancy mixes and store positioning, leveraging strongly off their supermarket anchors to the benefit of other major retailers and specialty fashion tenants. Women Mission shopping for Apparel are productive customers with a relatively high average spend per minute.

This should be rewarded and facilitated through services that encourage cross shopping. Examples might be central pick up points where goods from multiple shops can be collected, or a designated area in the car park where customers can retrieve their purchases on the way home.

Nothing encapsulates Mission shopping more than Food Retail purchases: in this category the efficiency of the supermarket industry is in tune with consumer behaviour. Mission shoppers conducting a Main Food shop have a strong spend per minute in centre, with an average spend of $139. They do not, though, exhibit a strong cross-shop. Drawing a more diverse spend from customers focused on a big trip to the supermarket is obviously something we’d all like. Again, services facilitating cross-shopping and ease of movement through centres could prove beneficial here.

Mission shopping accounts for the majority of purchases in Australian shopping centres, and while these shoppers spend less than their Leisurely counterparts, they do exhibit strong per minute spend and can be encouraged to cross-shop and move beyond their intended purpose. Efficiency is king for these shoppers and if we want them to extend their shopping trip and visit more stores, we need to make it easy and enticing for them. In our next edition of e-directions we’ll turn our gaze the other way for a look at the less productive but high spending Leisure shopper.