In the last few years there has been considerable movement within the Large Format Retail property sector. One reason for this is that enclosed, well-presented Homemaker Centres combine many of the strengths of traditional shopping centres – parking, air-conditioning, and amenable environments – with a specialised product category and customer focus.

There is no publicly available consumer research available on Homemaker centres in Australia so we thought we’d share with you some of our latest data.

In this article, we compare the shopper profile of Homemaker centres (HMCs) customers with those of traditional shopping centres (TSCs) using our proprietary 2013 Consumer Shopping Benchmarks.

Firstly, we see the average age of HMC customers is similar to the average age of customers in traditional shopping centres – however the spread across age cohorts is quite different.

In HMCs there is a peak in the 30-39 year age bracket with 23% of customers, while in TSCs the spread of customers between 20 and 70 years of age is more evenly distributed.

This difference in age distribution is reflective of the strong appeal Homemaker Centres have for those in the early lifestages such as Young Couples and Young Families. It is these Lifestages that are particularly attracted to homemaker centres as they are in the process of setting up house and family and investing in their domestic space by making purchases in furniture, white goods and children’s items.

While there is a strong appeal for those ‘setting up the home’, the Homemaker centre still has appeal across the age spectrums. The older age cohorts make up an important proportion of customer spend at Homemaker Centres. Being more strongly established and proud in their homes, these older customers spend more per visit even though they visit less frequently.

So while we have a good idea of who is actually purchasing at Homemaker Centres, what exactly are these customers looking for?

The top four product categories motivating shoppers to visit an average Homemaker centre include:

- Indoor Furniture (16%);

- Homewares (9%);

- Home Entertainment Equipment (7%), and

- Baby or Children’s Items (7%).

While the top four reasons to visit a Homemaker correspond to the idea of establishing a family nest, how does this translate to actual product conversion? We can see that the top goods and services purchased are:

- Food Catering (20%);

- Homewares (14%);

- Baby or Children’s Items (12%), and

- Home Entertainment Equipment (7%).

Interestingly, only 6% of customers buy Indoor Furniture on their visit, reflecting the time taken and comparative shopping pattern for this category and subsequent relatively low conversion rate of visitation to purchase.

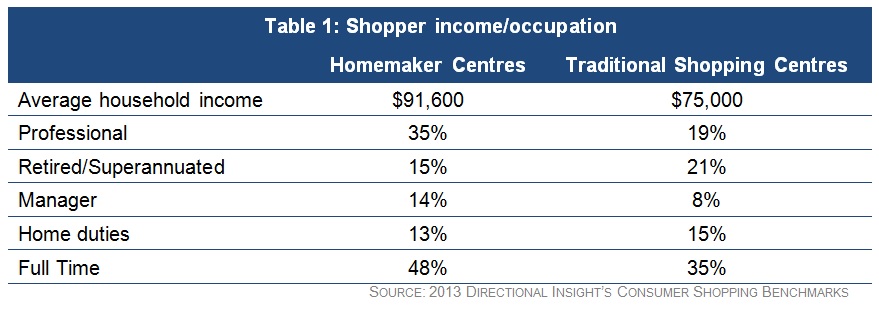

As Table 1 shows, shoppers at HMCs are on average more affluent than those visiting TSCs. They are also more likely to be in Professional or Managerial roles, and employed full-time, with a greater capacity to spend on the discretionary product mix of HMCs.

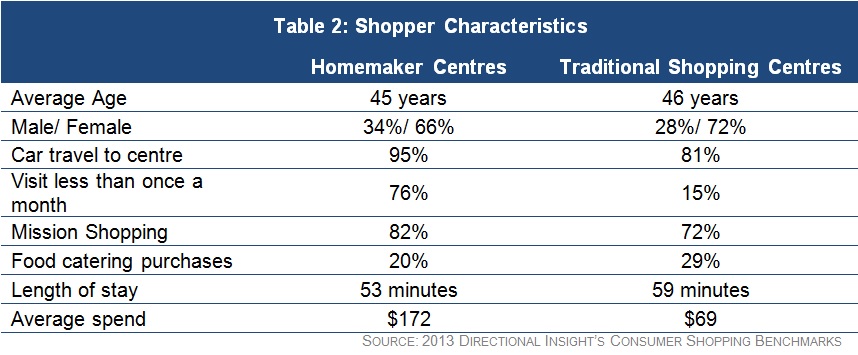

Table 2 provides some further details into the divergence between customers of these two shopping centre types. The primary point to be made is that the inherent nature of the HMC product categories result in much less frequent visitation. This means that information about way finding to the centre, and navigation within it, are very important because HMC customers are less familiar with the shopping environment than TSC customers.

Further, while the gender split for HMC is still bias towards females, there are a higher proportion of males visiting than at TSCs. This can be attributed to the appeal of the product mix of HMCs and that some of the larger value items such as furniture and white goods are more likely to be joint purchase decisions.

Additionally, men outspend women in HMCs, in contrast to their behaviour at TSCs where they are much more likely to be wallet shy.

Turning to look at shopping patterns, we can see that shopping in HMCs is targeted, with only 18% of customers reporting their shopping trip as Leisure oriented. In part this is an indication of the research surrounding bulky goods shopping. Generally, those researching beforehand are focused on what they’ve already been investigating and arrive at the centre with fairly specific items in mind. Therefore, it is very important that Homemaker centres facilitate efficiency to accommodate this high degree of Mission shopping.

When they do, they reap the rewards with HMCs drawing high average spends per customer, and even higher spends amongst those making a purchase ($222).

Homemaker and other large format retail centres are a specialised property category, with very few companies experienced in conducting consumer research for them. If you would like to know more about our expertise in this area, feel free to give us a call on 1300 138 651 or email us at info@directional.com.au