Clothing has been one of the hardest hit retail sectors in Australia since the GFC, with cautious spending, lower prices, high rents and online competition all contributing to a contraction in industry revenue. With competition hotting up, and the influx of international brands, change is the defining feature of the landscape ahead.

In this environment, we thought it would be helpful to examine the profile of Apparel shoppers who are not only the consumers of the retail clothing industry, but who make such an important contribution to Shopping Centres, particularly Sub-Regional and Regionals.

The following analysis has been conducted by extracting everyone who purchased an apparel item during their shopping trip when we interviewed them for our 2013 Australian Benchmarks – a total sample of over 6,000 shoppers!

Apparel shoppers are more leisurely shoppers than the average, as you would expect, and also spend considerably more time in centre than the norm. It takes time to try on clothes after all, and it is, by its nature, a comparative form of shopping: 12% of Apparel shoppers spend more than three hours in Australian shopping centres, compared with just 5% of customers overall. The average shopping trip for Apparel shoppers lasts over thirty minutes longer than the Directional Insights’ Benchmark average.

Also unsurprising is the fact that most apparel shoppers are women. What if we told you, though, that women make up 85% of apparel shoppers? This reiterates what we’ve commented on in e-directions previously [http://hoppingmadstagging.com/directional_old/whats-new/august-september-2012/]. Men tend to shop for themselves. Women shop for themselves and others, most notably family members.

This becomes clearer when we look at demographic profiles in the sample. Compared to the Benchmark average, Apparel shoppers are more likely to be engaged in home duties, be in Married/ Defacto relationships with children, and have children under fifteen years of age living at home. They also have larger average household sizes.

Apparel shoppers are willing to travel to buy. They are more likely than average to come from Secondary, Tertiary and Beyond the shopping centre trade area. A relatively low 42% come from the Primary Trade Area compared with the overall average of 54%. Apparel, then, is a lure; an appetising bait that can, with the right mix, draw customers from farther afield and from competing centres.

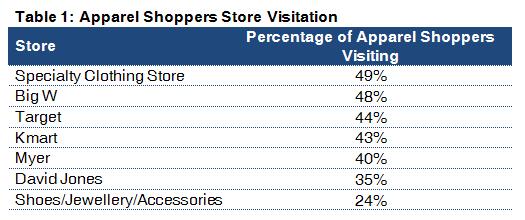

Table 1 shows the stores visitation percentages for customers purchasing Apparel. While the major department and discount department stores are clearly dominant, specialty clothing stores received the highest percentage of visitation. Specialty footwear and accessories stores also garnered the interest of a good percentage of Apparel shoppers. This suggests that specialty fashion retailers retain the potential to attract healthy foot traffic in major centres.

Cross visitation by Apparel shoppers is also good: 20% buy take-away food, a further 14% purchase from cafes or restaurants. Apparel shoppers also make good use of supermarkets, other specialty stores and services in-centre.

Lastly, and as ever, most importantly, Apparel shoppers are good spenders. Their average spend is $122.59, compared to the Benchmark average of $75.84 for purchasing customers. Their expenditure on all categories is generally good.

Apparel shoppers appear to be engaged shoppers – they visit and purchase from a broad range of stores, they spend a lot of time in centre, they spend well. This highlights the importance of fashion retailers ‘getting it right’. Their key shoppers enjoy shopping and do purchase when in centre. They’re willing to spend the time to be ‘sold’ on an item (or two or three). Despite the ongoing gloom and fierce competition, the well-positioned and managed store can do well. So while the changes ahead will bring casualties, we shouldn’t assume that revenue contraction will occur across the board. There is room, and a customer base, on which to flourish.