In the last edition of e-directions, we took a look at Apparel shoppers. We noted the high proportion of females and those engaged in home duties; their leisurely approach to shopping and their longer time in centre; their willingness to travel further; their healthy cross-visitation patterns; a propensity to refuel on take-away food and in cafes; and, most importantly, their high average spend.

Since that article we’ve fielded inquiries from clients wanting to know more. So we’ve dug a little deeper into the data to look at different groups of Apparel shoppers.

One question we ask of Apparel shoppers is whether they are buying for themselves or buying for others.

As you might expect, consumers buying Apparel for themselves adopt a more relaxed approach to their shopping trip, with 45% regarding their visit as Leisure oriented, compared with the, still high, 39% of those buying for others. Despite this, the latter group spend more time in centre. In part this shows the time required to find the right item in the desired style, colour, brand and so on, when the person you’re shopping with isn’t there.

But it’s also about the type of shopping trip undertaken, with those shopping for others engaged in more cross-visitation and cross category purchasing. While those shopping for themselves spend more on Apparel itself, those buying Apparel for others spend more on all other categories and have a higher average spend overall.

No prizes for guessing the influence of a home duties role: 25% of those buying Apparel for others are engaged in home duties, compared with 14% of those buying for themselves. Further, 51% of those buying Apparel for others live in Married/ de Facto relationships with children. Family lifestage is closely related to age, explaining the relatively low percentage of those buying for others who are under thirty. In contrast 30 to 49 year olds made up 47% of consumers buying Apparel for others. These figures all reinforce the analysis in our previous article on Apparel shoppers, highlighting the role that gender, family structure and lifestage play in Apparel purchases. It says something not just about shopping, but of women’s social roles: the very low percentage of male Apparel shoppers is even lower for those buying for others (12% compared with 15%).

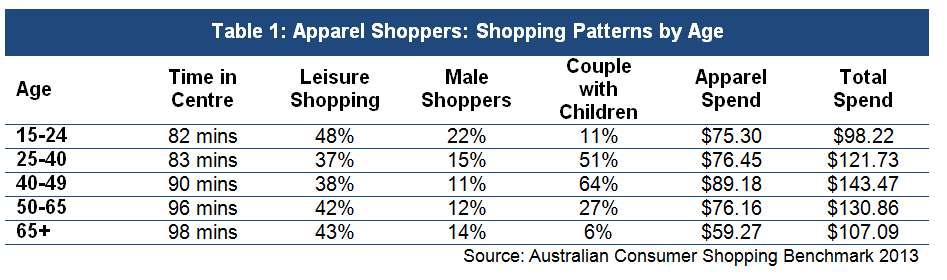

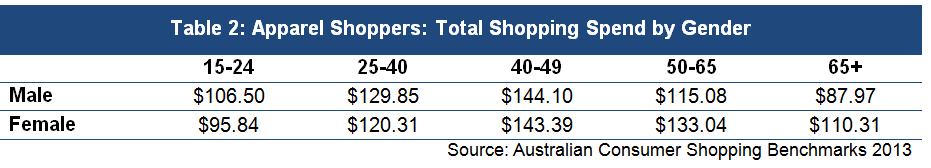

And as Table 1 shows, there is a decrease in male Apparel shoppers in the 40-65 year age groups when a partner is more likely to be purchasing Apparel on their behalf. More males return to the shops at retirement age. Table 2 shows that the average Apparel spend by men below 40 years of age is actually higher than for women of the same age, but after this there is a cross over with a growing gap between men and women’s average expenditure.

Average expenditure by Apparel shoppers is fairly healthy across age groups, but there are some variations related to lifestage and maturity.

As Table 1 shows, time in centre increases with age, while there is a hollowing out of Leisure shopping in the middle age brackets as consumers’ lifestyles become busier. This coincides with significant increases in expenditure, both for Apparel and overall.

Some other age-related patterns also emerge. The group sizes of Apparel shoppers tend to decrease with age while their loyalty increases: from 47% of customers in the 15-24 year age group, through to 59% of customers over 65 years of age, recording the subject centre as their regular place for non-food shopping.

Apparel shopping is obviously a personal and subjective experience. Everyone does it a little bit differently. But there are some broad patterns here that are useful for marketers and which can inform targeted and empathetic approaches to particular demographic and age groups. For more information on Apparel shoppers or a free presentation on this material, feel free to give us a call today on 1300 138 651 .